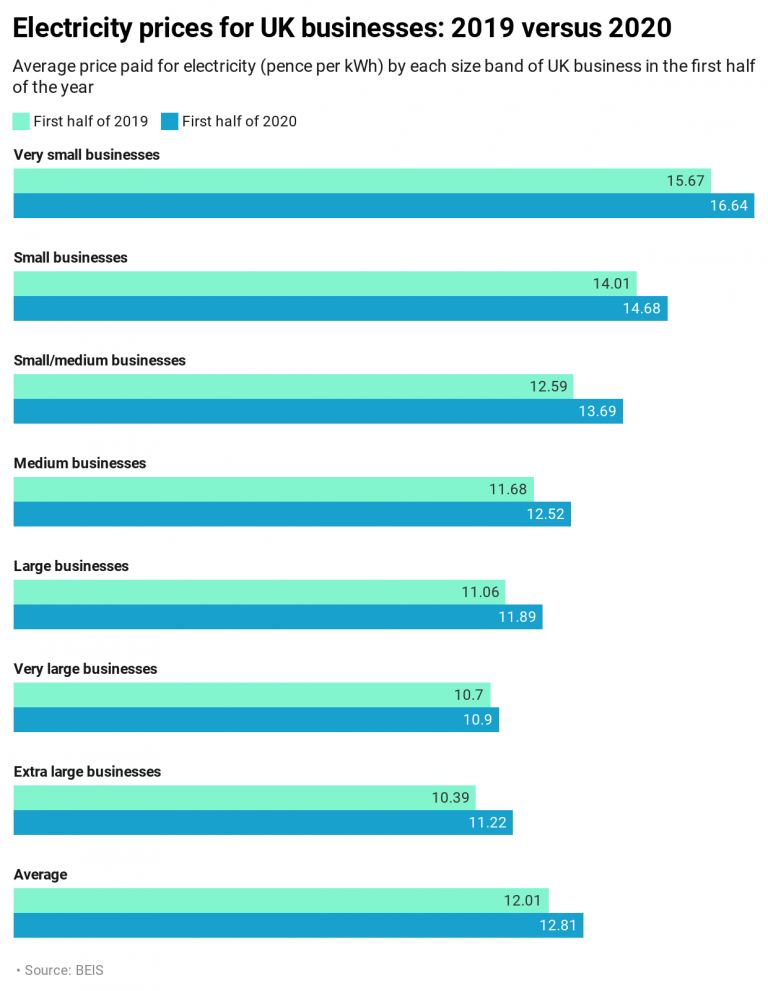

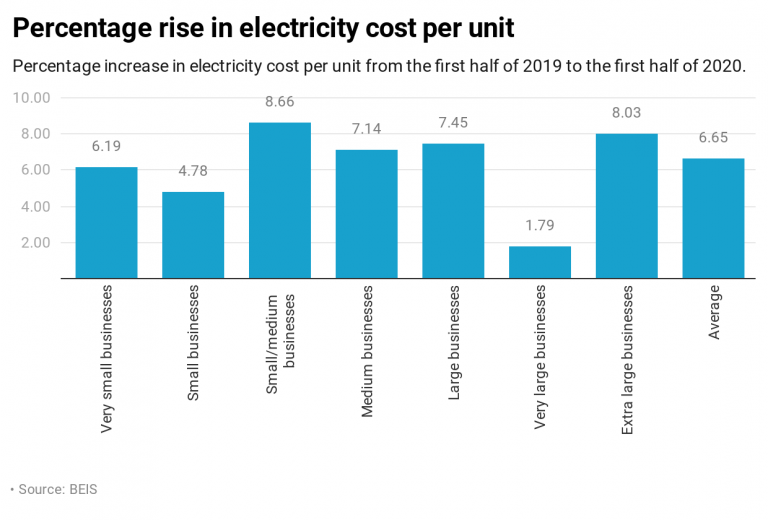

The latest data from the Department for Business, Energy and Industrial Strategy (BEIS) shows that while dealing with the onset of the pandemic in the first half of 2020, UK businesses also faced higher electricity costs compared with the same period last year.

The new BEIS figures for January to June 2020 show that every category of non-domestic electricity customer paid more per unit than they did in the first half of 2019.

The average price paid for electricity by business customers rose from 12.01 to 12.81 pence per kWh, a rise of 6.7%. Businesses in the small/medium consumption category saw the biggest rise, with an increase per unit of 8.66%.

Businesses classed as very large, the second-largest consumption category, saw the smallest rise (1.79%). They were already paying less than you might expect, given that suppliers set their tariffs based on consumption category. Normally, pricing per unit goes down as consumption goes up, but businesses classed as very large were already paying less per unit than those in the category above (extra large). Extra large companies saw an increase of 8.03% between the first half of 2019 to the first half of this year, increasing the discrepancy.

Energy prices reached record lows in April because of the drop in demand caused by the lockdown. Globally, demand for oil fell so low that it went into negative figures – traders were actually paying to get rid of it. But energy market prices have steadily risen since then.

Drop in energy demand

Despite the rise in electricity cost per unit, many businesses will have paid less in the first half of 2020 because of reduced consumption. In the second quarter of 2020, overall energy consumption was down by 29%, a record low. Transport sector consumption fell by 52%, industrial sector consumption fell by 19% and service sector consumption fell by 13%.

The mix of fuels in our energy supply has changed too. The National Grid responded to falling energy demand during lockdown by taking power plants off the network, and coal-fired plants were the first to go. As a result, Great Britain experienced its longest period without coal since 1882, a run of nearly 68 days that ended in June. Dependency on fossil fuels is at a record low, according to the BEIS figures.

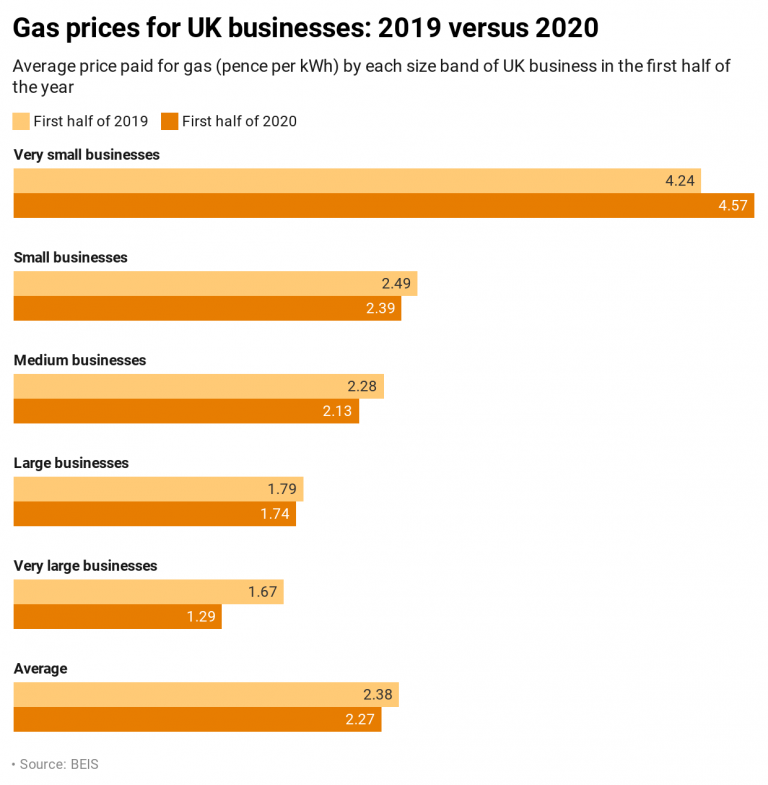

Most businesses paying less for gas

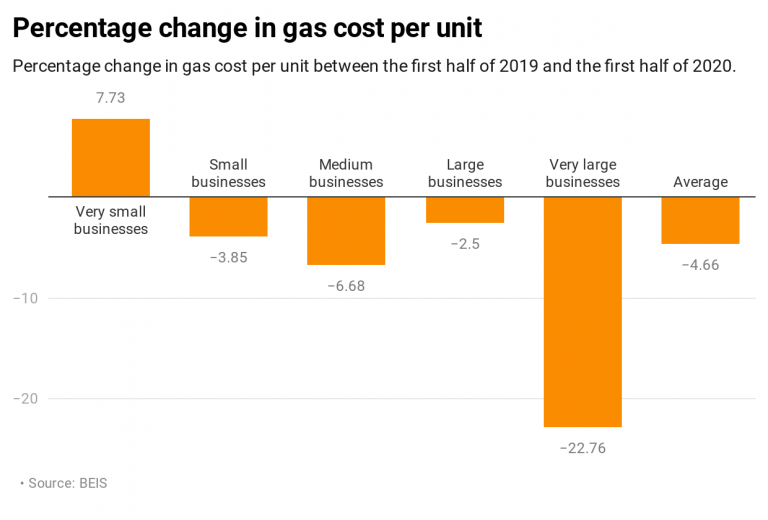

Gas prices have gone the opposite way from electricity, with all sizes of business except the very small category paying less for their gas in the first half of 2020.

This is to be expected, because in the first half of 2020, we had a plentiful supply of North Sea gas as well as liquefied natural gas (LNG) from sources around the world. This, combined with the reduction in demand, meant that the UK had enough to export some gas to the Continent as well as meeting its own energy needs.

Very small businesses pay even more

Businesses in the very small gas consumption category (those using less than 278 MWh per year) are the only category to see a price increase between the first halves of 2019 and 2020, despite already paying the most per unit.

Ofgem has certain measures in place to protect energy customers of this size, classed as “micro businesses”. Suppliers have obligations towards them that they don’t have towards bigger businesses, such as the requirements to offer shorter notice periods and provide more information on how their current deal compares with new prices. Very small businesses who are suffering the effects of gas price rises should make use of the rights they have and the information available to them to be proactive about switching supplier to save money.