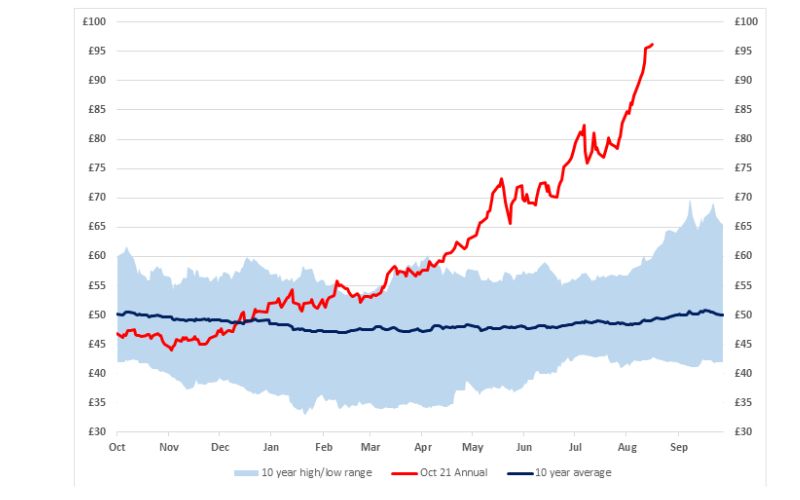

This week wholesale energy prices hit a record high, going over £100 per megawatt hour of energy for the Winter 21 seasonal power contract. Prices for this winter have reached highs not seen since 2008. It is a very different picture from recent months, which saw the wholesale price hit a 14-year low of just £35/MWh. Covid is just one of many factors increasing the volatility of world markets and leading to unprecedented situations such as last year’s negative oil price, which led to oil producers actually paying buyers to take the oil off their hands.

But if you’re a UK business, this volatility has serious consequences for your bottom line. Most high-volume corporate energy users without a robust energy strategy are now facing a 30% increase in energy costs. The reality for many businesses is that these unwelcome new costs could wipe out much of the hard-won growth achieved in recent months and years. If you have to absorb an increase in energy spend that could be as high as 5-8% of net profit, you’re running to stand still – cutting costs or boosting sales just to keep profits where they were before the energy spike.

It doesn’t have to be this way. BiU’s corporate customers are protected from the extremes of the wholesale energy markets because we use a variety of tools to help them keep costs steady.

Smarter flexible contracts

BiU helps businesses to find the right energy contract for their size, attitude to risk and brand values. While our smaller business customers seek a fixed energy price to enable simple energy budgeting, this isn’t the best approach for our bigger customers.

A larger business benefits greatly from some exposure to price risk with a flexible energy contract that utilises a risk managers market expertise to maximise potential savings. For instance;

A casual restaurant brand client:

Saved £221,000 just by taking advantage of market low prices due to our flexible procurement strategy and insights, which forms part of a wider £990,000 savings generated from our risk management team.

A retail group client:

Through a combination of good trading at the lower end of the market, reforecasting and selling back at higher prices, we’ve achieved a saving against market of over £1,137,000 against a total commodity cost.

It’s impossible to overstate the savings that can be made by working with the right energy consultant to secure the best contract. Many businesses are paying more than double what they could have been paying if they had locked down a good contract in advance.

Price protection through CPPAs

Corporate power purchase agreements (CPPAs) usually involve a direct agreement with a renewable energy generator to purchase energy at a fixed price over a given period of time. Businesses currently on CPPAs will typically be paying around £40-£50 per MWh – a big saving at a time when wholesale prices have just hit over £100/MWh and could do so again. Many businesses enter into renewable CPPAs not just for the price security, but also because supporting new renewables projects is an excellent way to reduce the carbon footprint of the business.

Although CPPAs are associated with large corporations such as McDonalds and Amazon, they actually work for a range of businesses sizes, provided you find a contract that is tailored to the individual needs of the business. BiU works with dozens of businesses every year to identify their needs, source potential CPPA partners and negotiate the best contract. Take a look at our CPPA guide to find out more.

Cutting consumption

If you can’t switch your energy supplier just yet, the quickest and most effective way to cut energy costs is to optimise energy consumption. BiU’s highly skilled energy engineers audit all your on-site assets to identify opportunities for greater efficiency, whether through upgrading equipment or changing the way in which it is used. We carry out staff training and work with your teams to help implement behavioural change.

One of the counterintuitive benefits of high energy prices is that it takes much less time for energy efficiency improvements to pay for themselves through the savings they deliver. At present we have several technologies that will pay for themselves well within two years.

The wholesale energy market is influenced by many different factors: the global economy, temperature changes, wind speeds, gas stocks, carbon pricing and more. Our experts are focused on these issues so that our customers don’t have to be. We can protect your business from market extremes so that you can focus on your core activities, safe in the knowledge that price spikes won’t undo the gains you are making.